Ultra Premium

Buy more templates at mediumrare.shop

Ultra Premium

Buy more templates at mediumrare.shop

The Commercial Intelligence Platform

Citrus gives commercial leaders direct control over disease market definitions, territory analytics, and real-world utilization — without vendor delays or fragmented workflows.

The Commercial Intelligence Platform

Citrus gives commercial leaders direct control over disease market definitions, territory analytics, and real-world utilization — without vendor delays or fragmented workflows.

The Commercial Intelligence Platform

Citrus gives commercial leaders direct control over disease market definitions, territory analytics, and real-world utilization — without vendor delays or fragmented workflows.

One Platform. End-to-End Commercial Clarity.

Citrus replaces static reports and multi-vendor workflows with a unified commercial intelligence system — from disease definition to territory execution.

Claims Intelligence

Claims Intelligence

Claims Intelligence

Enterprise-Grade Claims Intelligence

Citrus powers commercial planning with national, longitudinal claims intelligence attributed to the facility and provider level. Structured for disease definition, territory analytics, and payer mix visibility, the data foundation ensures every strategic decision reflects how care actually happens.

MARKET BASKET CREATION

MARKET BASKET CREATION

MARKET BASKET CREATION

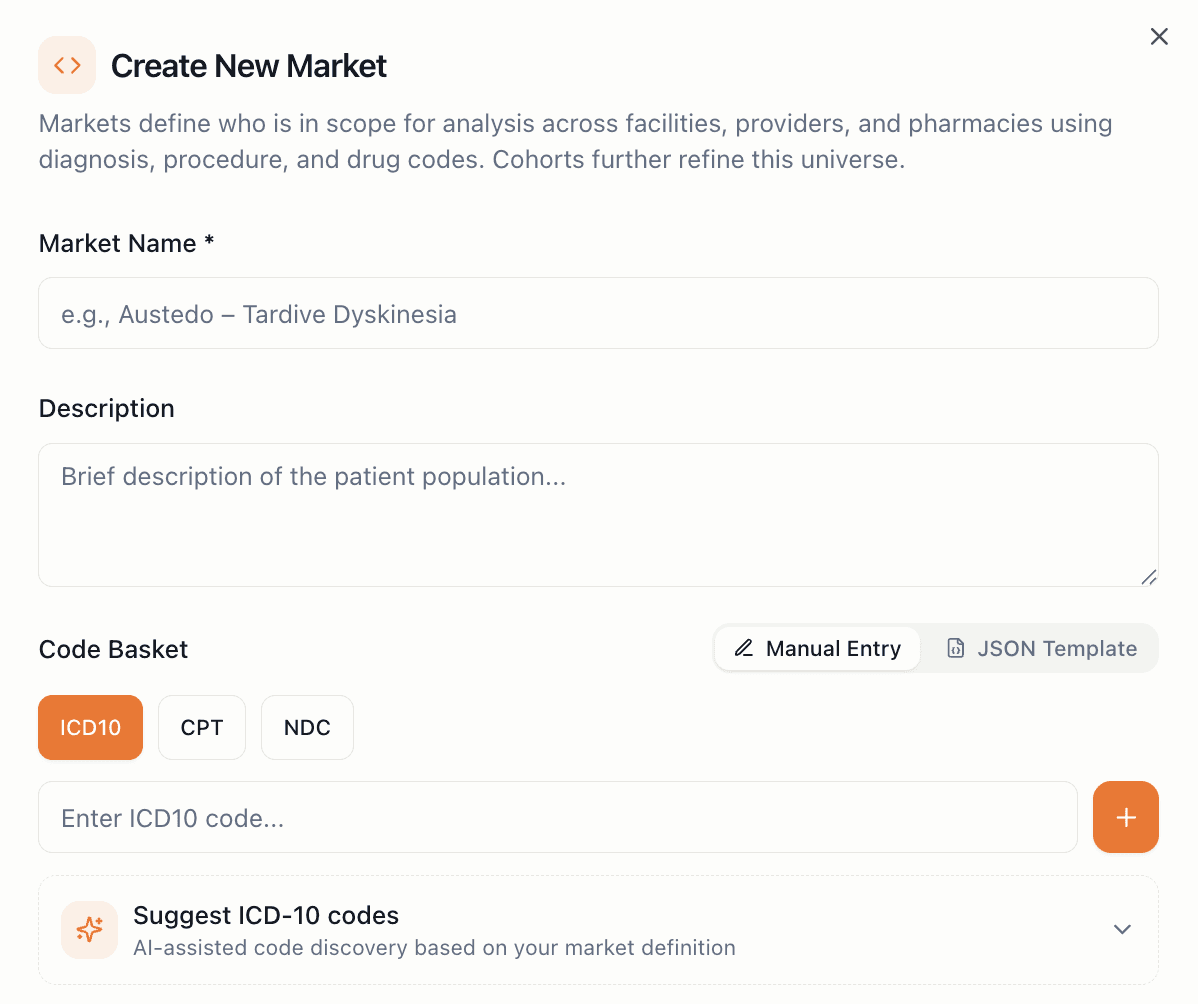

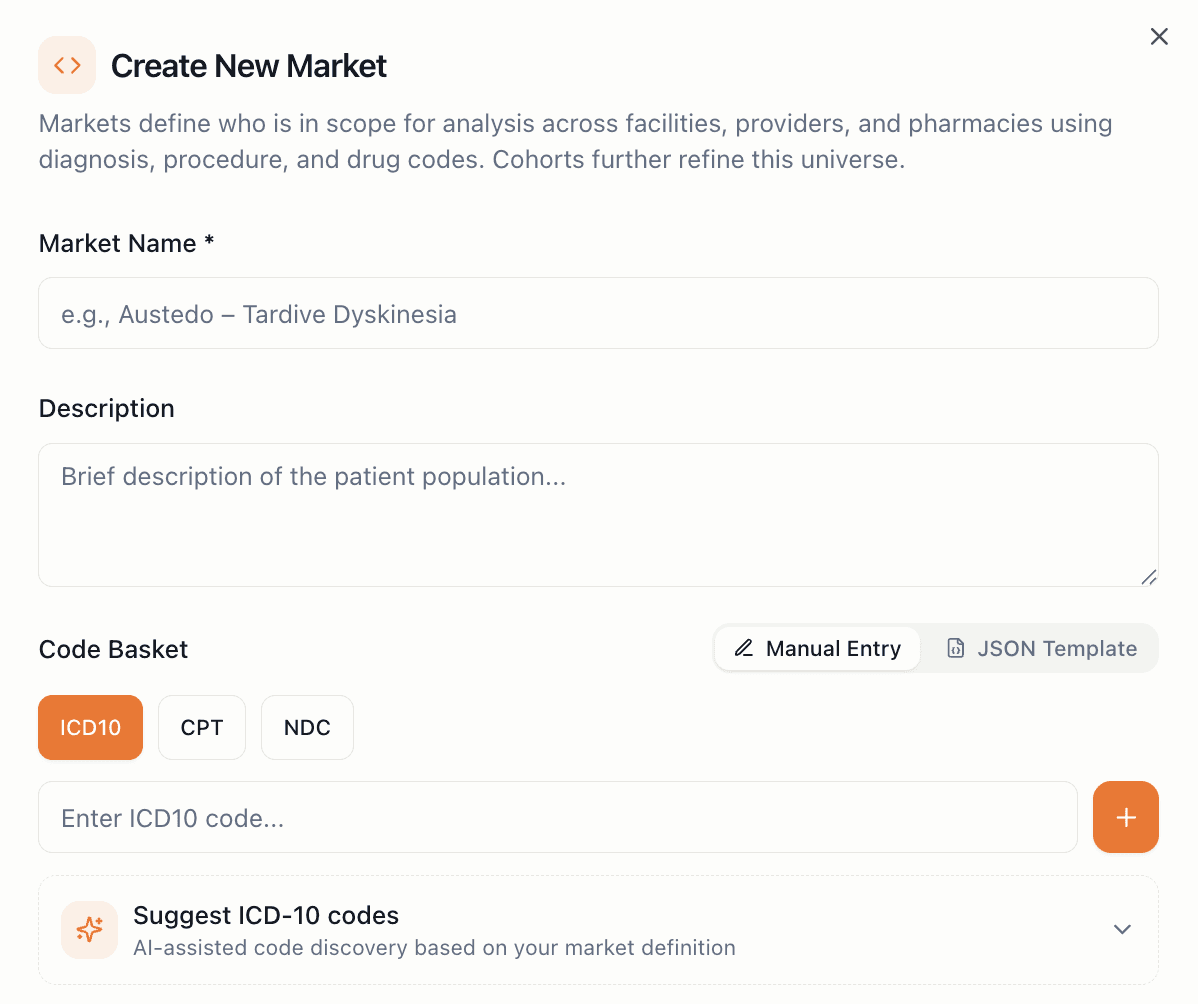

Self-Serve Disease Market Definition

Citrus enables commercial teams to build, refine, and validate disease market definitions directly with Medical and Analytics — without multi-month vendor cycles. Launch new indication analysis in weeks, pressure-test assumptions instantly, and iterate as strategy evolves. Move from hypothesis to validated opportunity before committing field resources or capital.

COMMERCIAL INTEGRATION

COMMERCIAL INTEGRATION

COMMERCIAL INTEGRATION

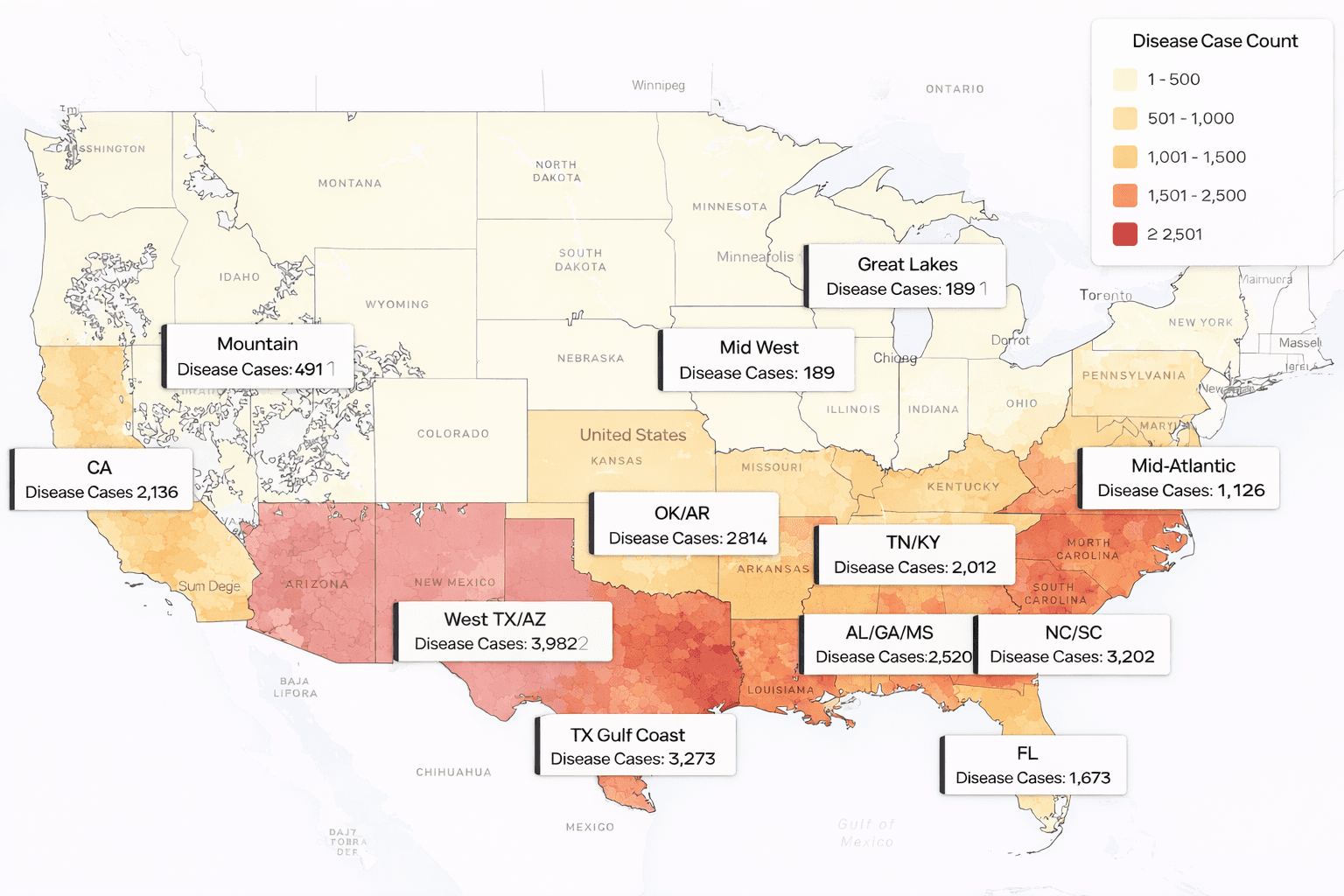

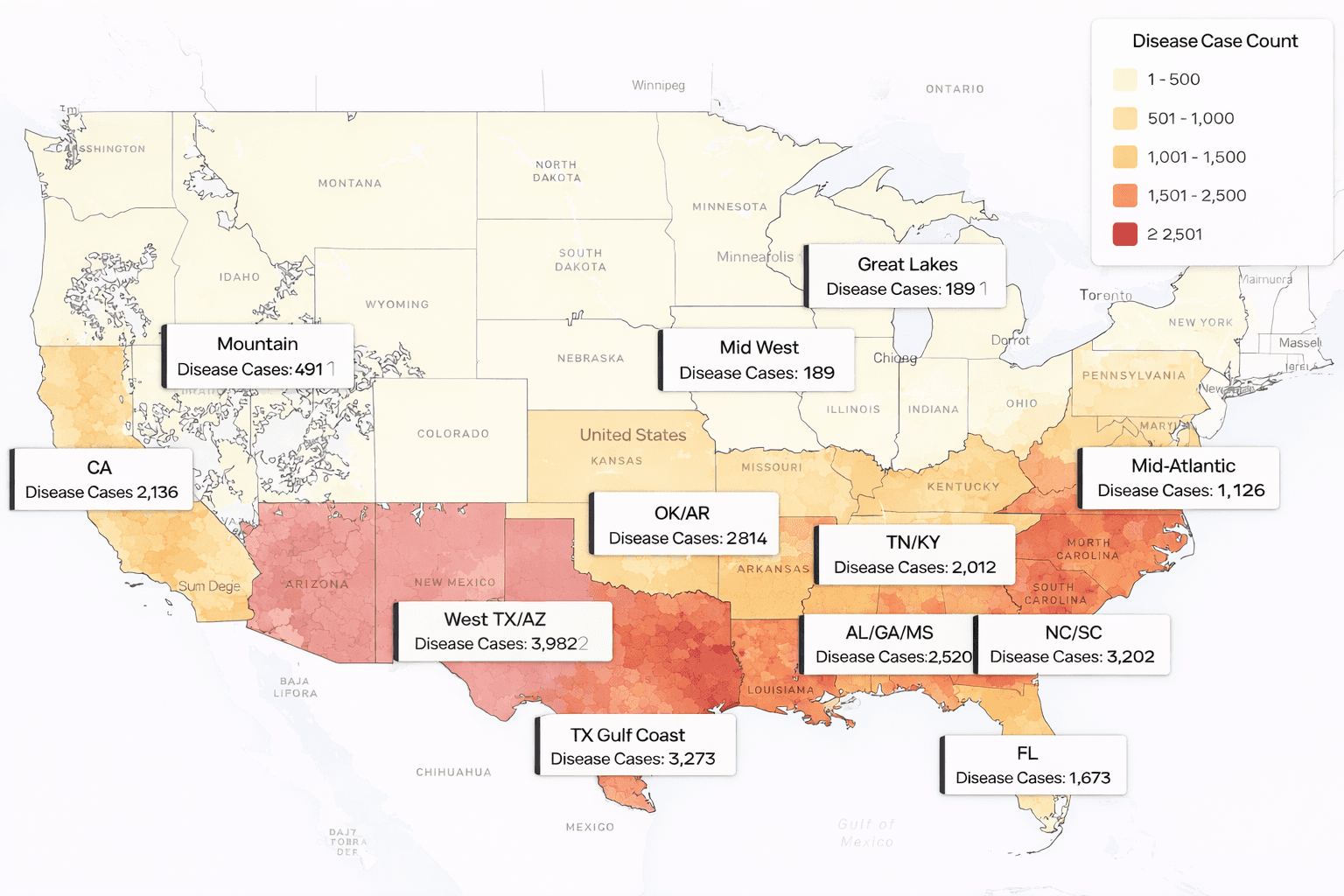

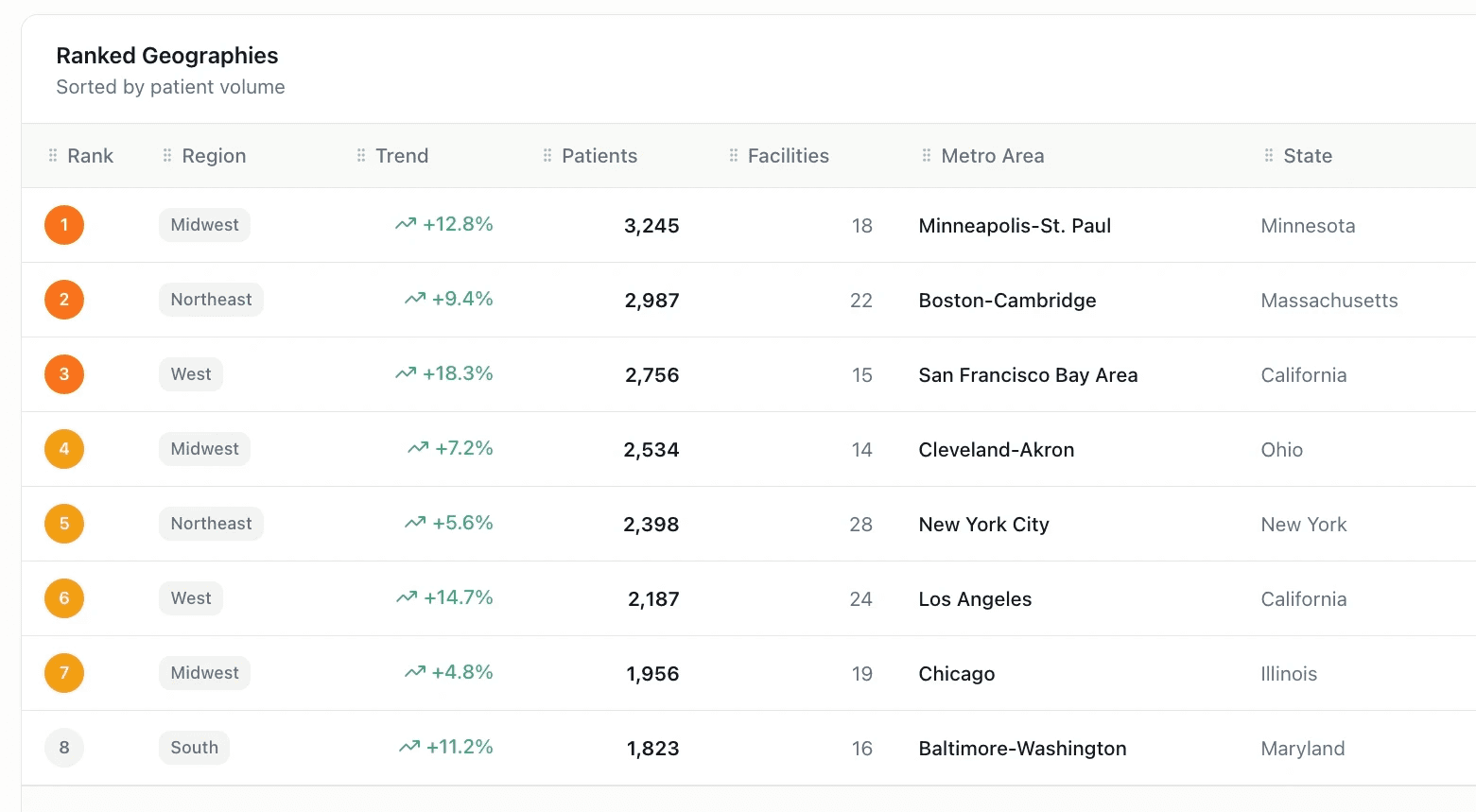

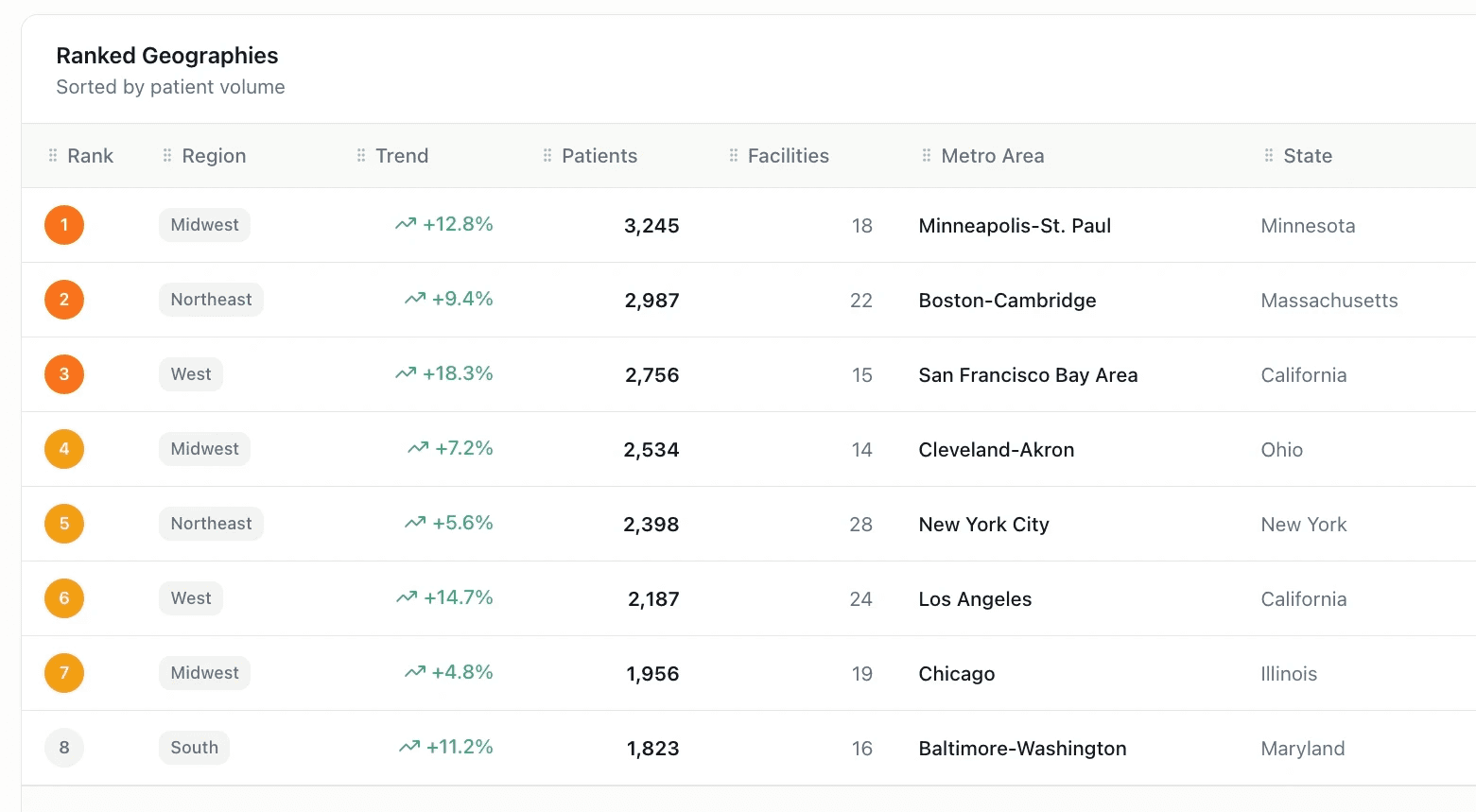

Connect Claims to Territory & Sales Strategy

Citrus merges internal territory alignments, account lists, and sales performance data with real-world utilization to measure penetration and uncover underpenetrated facilities. Tie patient concentration directly to field deployment and prioritize high-impact regions with confidence.

DASHBOARD & ALERTS

DASHBOARD & ALERTS

DASHBOARD & ALERTS

Real-Time Market & Territory Monitoring

Track regional growth patterns, facility concentration shifts, and payer mix changes through dynamic dashboards built for commercial planning. Automated alerts surface territory shifts and emerging opportunity before the next quarterly review.

Structured for clarity, and

Structured for clarity, and

Structured for clarity, and

ready to scale.

ready to scale.

ready to scale.

Frequently Asked Questions

What does Citrus do?

Citrus is a self-serve commercial intelligence platform built for pharmaceutical teams. It unifies national longitudinal medical and pharmacy claims with your internal commercial data to help teams define disease markets, measure penetration, identify white space, and monitor performance — in weeks rather than months. This means strategy, analytics, sales, and market access functions can generate defensible insights without custom vendor tickets or static reporting.

How is Citrus different from IQVIA, Komodo, and traditional claims vendors?

Unlike traditional claims vendors or heavyweight analytics suites, Citrus lets teams operate directly — without scoped consulting cycles or long delivery lead times. Where platforms like IQVIA or Komodo typically involve gated data access, multiple vendor tickets, and lagged refreshes, Citrus is built for iterative, self-serve analysis that reduces reliance on external tickets or protracted projects. This gives teams faster insight cycles, tighter control over definitions, and flexible commercial workflows.

Is claims data included — and what data/attribution is provided?

Yes. Citrus includes national medical and pharmacy claims with facility- and provider-level attribution, allowing teams to see real utilization patterns. You get payer mix, longitudinal patient journeys, and geographic concentration tied to clinical activity — not just summaries. This level of attribution supports defensible commercial analysis across territory, payer, provider, and regimen decisions.

How current is the data and how often is it refreshed?

Claims inherently reflect processing timelines set by payers; it’s common for adjudicated claims to have multi-month lag in industry datasets. Citrus regularly ingests and updates longitudinal claims, providing the freshest available data possible; however, analysis iteration — such as disease definition changes or territory pivots — can happen immediately within the platform. This distinction between claims adjudication lag and decision-ready update cycles helps teams reduce strategy lag even if raw claims have natural latency.

How does Citrus handle disease definitions and Medical validation?

Citrus enables true collaboration between Medical and Analytics teams by letting users create, refine, and version disease market baskets within the platform. Definitions can be instantly tested and iterated with clinical validation, eliminating spreadsheet misalignment and reducing dependency on multiple back-and-forth vendor requests. Teams maintain governance and version history — important for defensible board reporting and audit trails.

Can Citrus integrate our territory alignments, accounts, and sales performance data — and is this auto-refreshed?

Yes. Citrus supports bring-your-own-data (BYOD) for territory structures, account lists, and sales performance metrics, linking them to real utilization signals. Once integrated, these mappings refresh automatically as new claims and internal data sync — enabling live linkage between territory penetration and patient volume without manual rework. This makes Citrus actionable for Sales and Field Leadership, not just retrospective reporting.

How are penetration and white space calculated and validated?

Penetration scores are derived by comparing observed patient utilization tied to your accounts/territories against the total patient universe from claims. White space identifies underpenetrated facilities/regions where your patient share is below the theoretical opportunity. All calculations use real utilization and your own internal mappings, giving you metrics that reflect actual commercial context rather than generic proxies, and can be validated against defensible definitions.

Are cost fields (allowed amounts) actual or modeled/imputed?

Where cost fields (e.g., allowed or paid amounts) are present in the original claims data, Citrus reflects them as observed. In cases where payer-provider negotiated amounts are redacted or unavailable, Citrus documents any estimation or derived measures explicitly — so you always know whether a field is observed or calculated. This transparency addresses skepticism around modeled cost fields in incumbent ecosystems and supports more defensible budget modeling.

What security, privacy, and compliance practices does Citrus support?

Citrus is built to meet enterprise security, compliance, and governance expectations for healthcare analytics. Claims are handled in de-identified form (following industry guidelines), with role-based access controls (RBAC), single sign-on (SSO) support, audit logs, and configurable enterprise compliance posture. This approach balances analytical flexibility with enterprise risk management and audit readiness.

How is Citrus priced?

Citrus is offered as a subscription platform with pricing based on scope, users, and integration needs — not per-ticket consulting. Pricing transparency and engagement models are discussed early in evaluation calls, with options for pilots or scoped deployments to align with budget cycles and reduce pricing surprise risk. This approach avoids the “opaque pricing shock” commonly cited with legacy vendors, which often require bespoke contracts and multi-year commitments.

What does Citrus do?

Citrus is a self-serve commercial intelligence platform built for pharmaceutical teams. It unifies national longitudinal medical and pharmacy claims with your internal commercial data to help teams define disease markets, measure penetration, identify white space, and monitor performance — in weeks rather than months. This means strategy, analytics, sales, and market access functions can generate defensible insights without custom vendor tickets or static reporting.

How is Citrus different from IQVIA, Komodo, and traditional claims vendors?

Unlike traditional claims vendors or heavyweight analytics suites, Citrus lets teams operate directly — without scoped consulting cycles or long delivery lead times. Where platforms like IQVIA or Komodo typically involve gated data access, multiple vendor tickets, and lagged refreshes, Citrus is built for iterative, self-serve analysis that reduces reliance on external tickets or protracted projects. This gives teams faster insight cycles, tighter control over definitions, and flexible commercial workflows.

Is claims data included — and what data/attribution is provided?

Yes. Citrus includes national medical and pharmacy claims with facility- and provider-level attribution, allowing teams to see real utilization patterns. You get payer mix, longitudinal patient journeys, and geographic concentration tied to clinical activity — not just summaries. This level of attribution supports defensible commercial analysis across territory, payer, provider, and regimen decisions.

How current is the data and how often is it refreshed?

Claims inherently reflect processing timelines set by payers; it’s common for adjudicated claims to have multi-month lag in industry datasets. Citrus regularly ingests and updates longitudinal claims, providing the freshest available data possible; however, analysis iteration — such as disease definition changes or territory pivots — can happen immediately within the platform. This distinction between claims adjudication lag and decision-ready update cycles helps teams reduce strategy lag even if raw claims have natural latency.

How does Citrus handle disease definitions and Medical validation?

Citrus enables true collaboration between Medical and Analytics teams by letting users create, refine, and version disease market baskets within the platform. Definitions can be instantly tested and iterated with clinical validation, eliminating spreadsheet misalignment and reducing dependency on multiple back-and-forth vendor requests. Teams maintain governance and version history — important for defensible board reporting and audit trails.

Can Citrus integrate our territory alignments, accounts, and sales performance data — and is this auto-refreshed?

Yes. Citrus supports bring-your-own-data (BYOD) for territory structures, account lists, and sales performance metrics, linking them to real utilization signals. Once integrated, these mappings refresh automatically as new claims and internal data sync — enabling live linkage between territory penetration and patient volume without manual rework. This makes Citrus actionable for Sales and Field Leadership, not just retrospective reporting.

How are penetration and white space calculated and validated?

Penetration scores are derived by comparing observed patient utilization tied to your accounts/territories against the total patient universe from claims. White space identifies underpenetrated facilities/regions where your patient share is below the theoretical opportunity. All calculations use real utilization and your own internal mappings, giving you metrics that reflect actual commercial context rather than generic proxies, and can be validated against defensible definitions.

Are cost fields (allowed amounts) actual or modeled/imputed?

Where cost fields (e.g., allowed or paid amounts) are present in the original claims data, Citrus reflects them as observed. In cases where payer-provider negotiated amounts are redacted or unavailable, Citrus documents any estimation or derived measures explicitly — so you always know whether a field is observed or calculated. This transparency addresses skepticism around modeled cost fields in incumbent ecosystems and supports more defensible budget modeling.

What security, privacy, and compliance practices does Citrus support?

Citrus is built to meet enterprise security, compliance, and governance expectations for healthcare analytics. Claims are handled in de-identified form (following industry guidelines), with role-based access controls (RBAC), single sign-on (SSO) support, audit logs, and configurable enterprise compliance posture. This approach balances analytical flexibility with enterprise risk management and audit readiness.

How is Citrus priced?

Citrus is offered as a subscription platform with pricing based on scope, users, and integration needs — not per-ticket consulting. Pricing transparency and engagement models are discussed early in evaluation calls, with options for pilots or scoped deployments to align with budget cycles and reduce pricing surprise risk. This approach avoids the “opaque pricing shock” commonly cited with legacy vendors, which often require bespoke contracts and multi-year commitments.

What does Citrus do?

Citrus is a self-serve commercial intelligence platform built for pharmaceutical teams. It unifies national longitudinal medical and pharmacy claims with your internal commercial data to help teams define disease markets, measure penetration, identify white space, and monitor performance — in weeks rather than months. This means strategy, analytics, sales, and market access functions can generate defensible insights without custom vendor tickets or static reporting.

How is Citrus different from IQVIA, Komodo, and traditional claims vendors?

Unlike traditional claims vendors or heavyweight analytics suites, Citrus lets teams operate directly — without scoped consulting cycles or long delivery lead times. Where platforms like IQVIA or Komodo typically involve gated data access, multiple vendor tickets, and lagged refreshes, Citrus is built for iterative, self-serve analysis that reduces reliance on external tickets or protracted projects. This gives teams faster insight cycles, tighter control over definitions, and flexible commercial workflows.

Is claims data included — and what data/attribution is provided?

Yes. Citrus includes national medical and pharmacy claims with facility- and provider-level attribution, allowing teams to see real utilization patterns. You get payer mix, longitudinal patient journeys, and geographic concentration tied to clinical activity — not just summaries. This level of attribution supports defensible commercial analysis across territory, payer, provider, and regimen decisions.

How current is the data and how often is it refreshed?

Claims inherently reflect processing timelines set by payers; it’s common for adjudicated claims to have multi-month lag in industry datasets. Citrus regularly ingests and updates longitudinal claims, providing the freshest available data possible; however, analysis iteration — such as disease definition changes or territory pivots — can happen immediately within the platform. This distinction between claims adjudication lag and decision-ready update cycles helps teams reduce strategy lag even if raw claims have natural latency.

How does Citrus handle disease definitions and Medical validation?

Citrus enables true collaboration between Medical and Analytics teams by letting users create, refine, and version disease market baskets within the platform. Definitions can be instantly tested and iterated with clinical validation, eliminating spreadsheet misalignment and reducing dependency on multiple back-and-forth vendor requests. Teams maintain governance and version history — important for defensible board reporting and audit trails.

Can Citrus integrate our territory alignments, accounts, and sales performance data — and is this auto-refreshed?

Yes. Citrus supports bring-your-own-data (BYOD) for territory structures, account lists, and sales performance metrics, linking them to real utilization signals. Once integrated, these mappings refresh automatically as new claims and internal data sync — enabling live linkage between territory penetration and patient volume without manual rework. This makes Citrus actionable for Sales and Field Leadership, not just retrospective reporting.

How are penetration and white space calculated and validated?

Penetration scores are derived by comparing observed patient utilization tied to your accounts/territories against the total patient universe from claims. White space identifies underpenetrated facilities/regions where your patient share is below the theoretical opportunity. All calculations use real utilization and your own internal mappings, giving you metrics that reflect actual commercial context rather than generic proxies, and can be validated against defensible definitions.

Are cost fields (allowed amounts) actual or modeled/imputed?

Where cost fields (e.g., allowed or paid amounts) are present in the original claims data, Citrus reflects them as observed. In cases where payer-provider negotiated amounts are redacted or unavailable, Citrus documents any estimation or derived measures explicitly — so you always know whether a field is observed or calculated. This transparency addresses skepticism around modeled cost fields in incumbent ecosystems and supports more defensible budget modeling.

What security, privacy, and compliance practices does Citrus support?

Citrus is built to meet enterprise security, compliance, and governance expectations for healthcare analytics. Claims are handled in de-identified form (following industry guidelines), with role-based access controls (RBAC), single sign-on (SSO) support, audit logs, and configurable enterprise compliance posture. This approach balances analytical flexibility with enterprise risk management and audit readiness.

How is Citrus priced?

Citrus is offered as a subscription platform with pricing based on scope, users, and integration needs — not per-ticket consulting. Pricing transparency and engagement models are discussed early in evaluation calls, with options for pilots or scoped deployments to align with budget cycles and reduce pricing surprise risk. This approach avoids the “opaque pricing shock” commonly cited with legacy vendors, which often require bespoke contracts and multi-year commitments.