The Commercial Reality

Pharma Teams Face

Pharma leaders are expected to allocate capital precisely, defend every territory investment, and accelerate growth — yet commercial planning often relies on

vendor-driven timelines, modeled projections, and proxy signals

that lag real-world care patterns.

Where Commercial Planning Breaks Down

Where Commercial

Planning Breaks Down

Disease market definitions and territory sizing require months of vendor coordination, internal modeling, and iterative validation.

Commercial decisions are often based on modeled estimates or survey proxies — not actual patient concentration at the facility and territory level.

Lean analytics teams are buried in ad hoc requests, manual reporting, and fragmented tools — limiting their ability to drive proactive strategy.

See the Market as It Actually Operates

Commercial decisions shouldn’t rely on assumptions. Citrus delivers longitudinal, real-world claims intelligence that shows where patients are treated, how care patterns shift, and where opportunity is emerging — in real time.

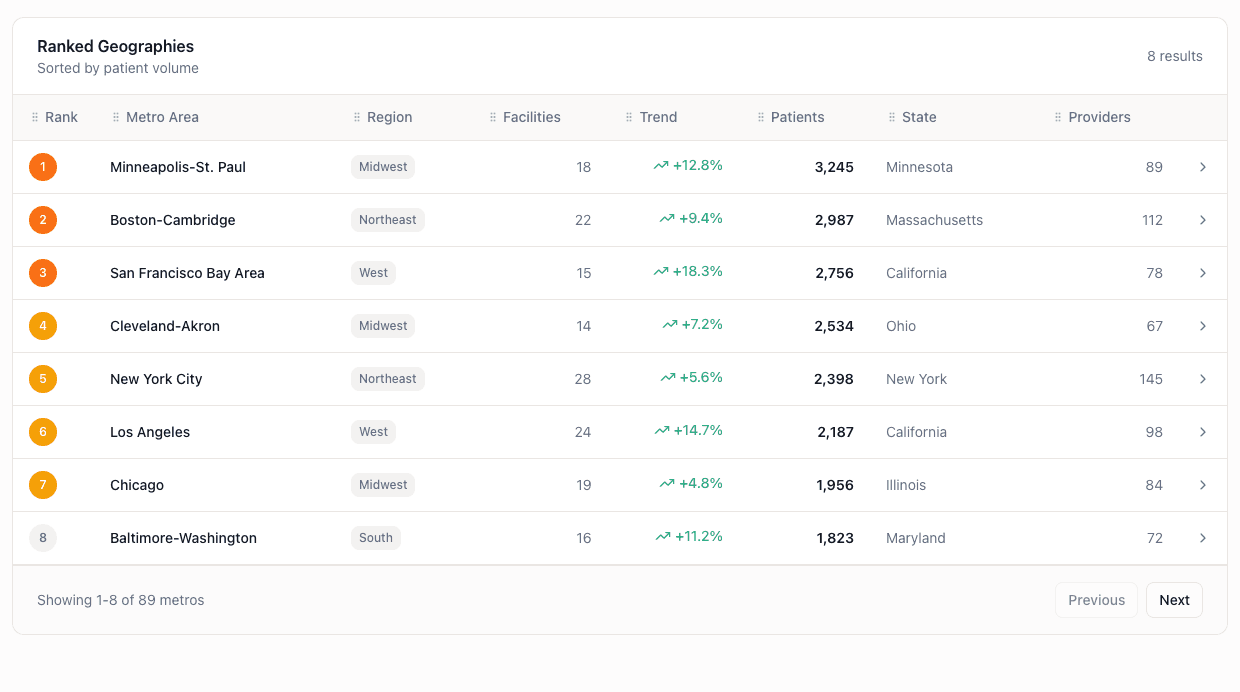

Quantify the Market Using Real Utilization

Analyze national, longitudinal claims to measure disease prevalence, treatment activity, and payer mix — grounded in actual patient behavior, not modeled estimates.

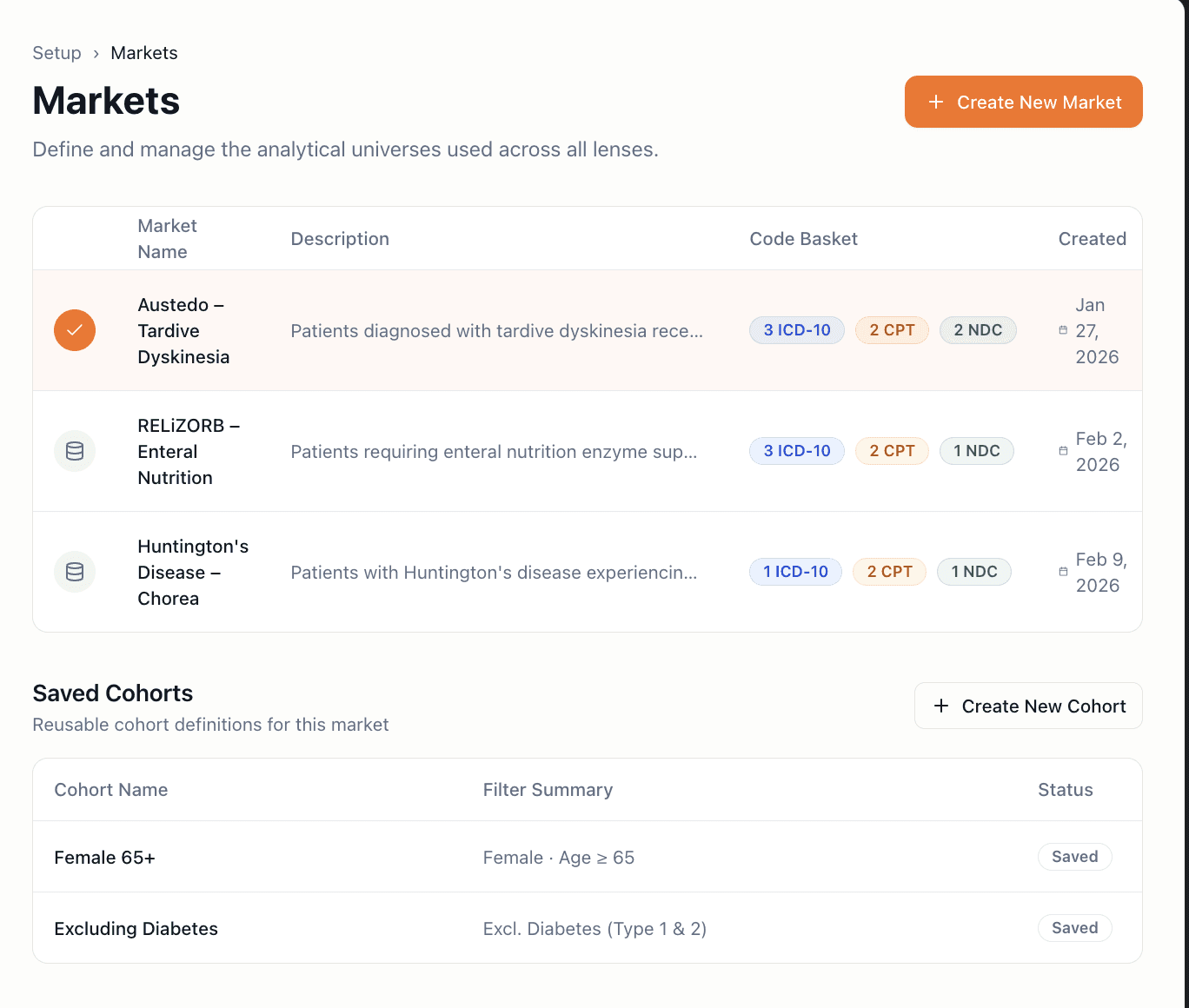

Define Disease Markets — Without Vendor Delays

Disease Market Basket Creation

Create, refine, and validate disease definitions directly with your Medical and Analytics teams — without vendor tickets or multi-month data cycles. Launch new indication analysis in weeks, pressure-test assumptions instantly, and iterate as strategy evolves.

Connect Claims Intelligence to Your Commercial Strategy

Merge territory alignments, account lists, and sales performance data with real-world utilization to measure penetration, uncover underpenetrated facilities, and prioritize high-impact regions.

Quantify the Market Using Real Utilization

Analyze national, longitudinal claims to measure disease prevalence, treatment activity, and payer mix — grounded in actual patient behavior, not modeled estimates.

Define Disease Markets — Without Vendor Delays

Disease Market Basket Creation

Create, refine, and validate disease definitions directly with your Medical and Analytics teams — without vendor tickets or multi-month data cycles. Launch new indication analysis in weeks, pressure-test assumptions instantly, and iterate as strategy evolves.

Connect Claims Intelligence to Your Commercial Strategy

Merge territory alignments, account lists, and sales performance data with real-world utilization to measure penetration, uncover underpenetrated facilities, and prioritize high-impact regions.

Quantify the Market Using Real Utilization

Analyze national, longitudinal claims to measure disease prevalence, treatment activity, and payer mix — grounded in actual patient behavior, not modeled estimates.

Define Disease Markets — Without Vendor Delays

Disease Market Basket Creation

Create, refine, and validate disease definitions directly with your Medical and Analytics teams — without vendor tickets or multi-month data cycles. Launch new indication analysis in weeks, pressure-test assumptions instantly, and iterate as strategy evolves.

Connect Claims Intelligence to Your Commercial Strategy

Merge territory alignments, account lists, and sales performance data with real-world utilization to measure penetration, uncover underpenetrated facilities, and prioritize high-impact regions.